https://https://www.pau.go.ugwww.pau.go.ug

BACKGROUND

In Uganda, the most prospective area with potential for Petroleum is the Albertine Graben. The first assessment of the oil and gas potential of Uganda was made by a Government Geologist by the names: E.J. Wayland who documented hydrocarbon occurrences in the Albertine Graben in the 1920s. This was followed by drilling of many shallow wells around Butiaba and Kibiro localities with the deepest well called Waki-B-1 drilled in 1938. Thereafter, there was no activity until the 1980s because of political instabilities due to the second World War and the post-independence turmoil in the Country.

There was however renewed interest in the region in the early/mid-eighties. Subsequently, in 1983/4 aero-magnetic survey was undertaken to quickly identify potential areas with the hydrocarbons in the western part (Rift System) of the country. In 1984 a Petroleum Unit under the Department of Geological Survey and Mines was created and in the following year the first legislation for petroleum exploration and production was enacted in 1985. The 1990s saw the acquisition of additional geological and geophysical data which was used to promote oil exploration in Uganda in International Fora.

These efforts were successful and the country was able not only to attract investors but investment capital as well. Companies that specialize in exploration were licensed – starting with Petro Fina in 1991 and Uganda General Works Engineering Company in 1993. These two companies although they did not do any work, they opened the door for more serious investment.

Their successors Heritage Oil and Gas Limited (Heritage), Hardman Petroleum and Energy Africa, licensed between 1997 and 2004 in different areas, undertook the more expensive seismic surveys and drilling on land and Lake Albert.

The first deep wells (Turaco- 1, 2, 3) that were drilled by Heritage in the Semliki Basin between 2002 and 2004 (in Western Uganda) did have positive results in terms of encountering some hydrocarbons. This restored the hope of those that had vested their time, money and in-deed their lives in this sector. This good news however had mixed results as the natural gas tested in the Turaco-3 well was heavily contaminated with Carbon dioxide. The technology to process this gas exists, and both gas and CO2 can be commercially viable. But it is important to appreciate that the focus at this time was the search for oil before options of utilizing the gas could be explored further, especially in a frontier basin where no prior discovery had been made.

Heritage relinquished this area but was later convinced to acquire a license in Exploration Area 3A and Exploration Area 1, along with a partner, Energy Africa in 2004. For Hardman Africa, the story was better. Ugandan scientists, who basing on the interpretation of the data acquired insisted that the next wells are drilled on land in Kaiso Tonya (Hoima District) rather than the lake. It would have taken longer and more expensive to mobilize the equipment to drill on the lake

Mputa-1 well was drilled in December 2005 and on 6th January 2006 it struck oil and was declared the first commercial discovery in Uganda. Other discoveries made thereafter were Waraga, Kajubilirizi (Kingfisher), Nzizi, Ngassa, Taitai, Karuka, Ngege, Kasamene, Kigogole, Ngiri, Jobi- Rii, Nsoga, Wahrindi, Ngara, Nsoga, Mpyo, Jobi-East, Gunya, and Lyec.In total the country has so far made 21 discoveries.

Data Acquisition

To date thirty-three (33) seismic surveys have been undertaken resulting in the acquisition of 7,580.6 line Kilometres of Two Dimensional (2-D) seismic data and 1,948.6 square kilometres of Three Dimensional (3-D) Seismic data.

One hundred and twenty one (121) exploration and appraisal wells have been drilled with one hundred and six (106) wells encountering oil and/or gas which is an unprecedented drilling success rate of over 85%. This includes 39 Exploration and 82 Appraisal Wells with 36 wells flow tested.

In addition, over 10,000 kilometres of geological mapping has been undertaken and Aerial Magnetic Data, Ground Gravity & Magnetic Data, Full Tensor Radiometry Data has also been acquired.

Uganda’s First Competitive Licensing Round for New Exploration

During September/ October 2017, Government of Uganda signed three Production Sharing Agreements (PSA) and issued:

- One License for Petroleum Exploration, Development and Production over the Kanywataba Contract Area to Armour Energy Limited (AEL) from Australia.

- Two Licenses for Petroleum Exploration, Development and Production over the Ngassa Shallow and Ngassa Deep Contract Areas to Oranto Petroleum Limited from Nigeria.

These are the first Production Sharing Agreements to be signed in line with Section 58 of the Petroleum Exploration, Development and Production Act 2013, the Legal regime under which the Minister for Energy and Mineral Development announced the First Competitive Licensing Round during February 2015.

Some of the key provisions of each of the PSA include;

- Exploration licenses with an acreage of 344 sq. kilometer (Kanywataba) and 410 sq. Kilometer (Ngassa) for four years split into two periods of two years each.

- A minimum work programme which includes acquisition of seismic data and drilling of atleast one well.

- An Advisory Committee chaired by the Petroleum Authority of Uganda, and consisting of representatives from Government and the Licensee to review and approve all annual exploration work programmes, budgets and production forecasts.

- Payment of Royalty based on the Gross Total Daily Production in Barrels of Oil Per Day (BOPD). The rate of royalty ranges from 5.5% to 21%.

- State Participation by Government or its Nominee at not more than 20%.

- Cost Recovery limit for Petroleum is set at 65%.

- Production Sharing.

- A Signature Bonus together with Research and Training fees, and Annual Acreage Rental fees for the First Exploration Period paid to the Uganda Petroleum Fund.

- A Performance (Bank) Guarantee amounting to 50% of the Minimum Exploration Expenditure for the First Exploration Period.

- Taxes will be paid in accordance with the Laws of Uganda; and

- A requirement to train and employ suitably qualified Ugandan citizens has been provided for in addition to payment of annual training fees to Government.

The award of the three (3) licenses were cleared by Cabinet and the Ministries of Finance, Planning and Economic Development together with that of Justice and Constitutional Affairs. The negotiated Production Sharing Agreements (PSAs) were laid before Parliament. The implementation of the agreed work programmes by the two Licensees is being monitored and regulated by the Petroleum Authority of Uganda.

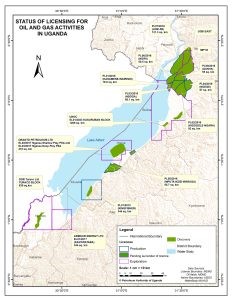

Uganda’s first licensing round covered six blocks with a total acreage of 2,674 Km2 in the Albertine Graben, Uganda’s most prospective sedimentary basin. Out of the nineteen (19) applicants at the Request for Qualification Stage, sixteen (16) proceeded to the Request for Proposal stage and four emerged successful bidders and proceeded to the negotiations stage.

This first licensing round was undertaken in line with the National Oil and Gas Policy for Uganda (2008) and in accordance with the Petroleum (Exploration, Development and Production) Act 2013. Eventually, this led to the award of three Petroleum Exploration Licences (PELs) to Oranto Petroleum Ltd (Ngassa Deep Play and Ngassa Shallow Play PELs) and to Armour Energy Ltd (the Kanywataba PEL).

Uganda’s Second Licensing Round

Following Cabinet approval, the Minister, MEMD launched the second licensing round for petroleum exploration at the 9th East African Petroleum Conference and Exhibition in Mombasa, Kenya during May 2019.

This licensing round covers five blocks in the Albertine Graben, namely;

- LR2_2019_Block01 (Avivi); Area coverage of 1026km2

- LR2_2019_Block02 (Omuka); Area coverage of 750km2

- LR2_2019_Block03 (Kasuruban); Area coverage of 1285km2

- LR2_2019_Block04 (Turaco); Area coverage of 637km2

- LR2_2019_Block05 (Ngaji); Area coverage of 1230km

The second licensing round will be undertaken in three stages namely; (i) the Request for Qualification (RfQ), (ii) Request for Proposal (RfP) and; (iii) the negotiation of Production Sharing Agreement. The Licensing round is expected to last twenty (20) months and will be concluded during 2020/2021.

For more information on how to participate, contact

Manager, Second Licensing Round

Directorate of Petroleum, Ministry of Energy and Mineral Development

Email: secondlicensing@petroleum.go.ug / directorate@petroleum.go.ug

Website: www.petroleum.go.ug.

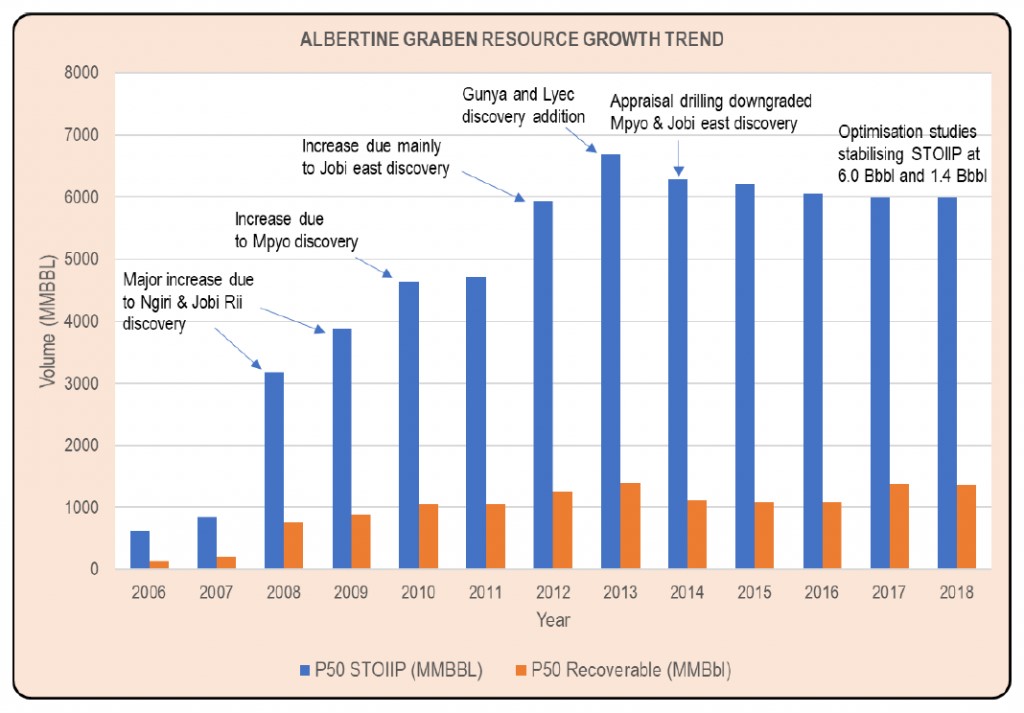

UGANDA’S PETROLEUM RESOURCE POTENTIAL

The Oil and Gas (O&G) fields, whose resource potential have been evaluated include Kingfisher, Mputa, Waraga, Nzizi, Kasamene, Kigogole, Nsoga, Wahrindi, Ngara, Ngege, Ngiri, Jobi-Rii and Gunya, all of which are under production licenses. This is in addition to Mpyo and Jobi East which are under appraisal together with Lyec field which has reverted to Government. Also assessed is the potential for prospective resources within Ngassa, Kanywataba, Turaco, Taitai, Karuka and other areas of the Albertine Graben with data. The exploration and appraisal of the O&G discoveries in the Albertine Graben has led to an increase in the country’s petroleum resource base from an estimated 3.5 Billion barrels of Stock Tank Oil Initially in Place (STOIIP), when the O&G policy was approved in February 2008, to the current estimate of 6.5 billion barrels, of which, 1.4 billion barrels is estimated as recoverable. In addition, gas resources are currently estimated at 600 Billion standard Cubic Feet (BCF).

PETROLEUM RESOURCE CLASSIFICATION

Uganda’s petroleum resources are classified in accordance with Society of Petroleum -Petroleum Resources Management (SPE-PRMS) as Reserves, Contingent resources, and Prospective resources. The resources documented for Uganda include both the discovered (Reserves and Contingent resources) and undiscovered (Prospective) resources. The petroleum resource estimates for the country are generated based on the Petroleum Authority of Uganda’s (PAU’s) assessment using the available data and harmonization with the resource reports submitted by the Licensees. Reserves are quantities of petroleum anticipated to be commercially produced, from known accumulations, by applying available technology to develop the projects from a given date under defined conditions. Reserves must satisfy the four (4) criteria of having been discovered, recoverable, commercial, and remaining (that is, still available at the date applied). For the Albertine Graben therefore, reserves include recoverable petroleum resources in the oil fields for which production licenses have been granted and Front-End Engineering Designs (FEED) have been completed. ‘Reserves’, are therefore, only in the oil fields, for which the Final Investment Decision (FID) has been taken and are currently estimated to be 1.0 billion barrels. Contingent resources are quantities of petroleum estimated to be potentially recoverable, but currently not considered to be commercially recoverable due to one or more contingencies. Contingent resources may include; projects where the development plans have not yet been approved, where commercial recovery is dependent on technology under development, where data is insufficient to clearly assess commerciality, or where regulatory or social acceptance concerns may exist. In the Albertine Graben, Contingent resources include those from discoveries whose development plans are still under consideration, those which will come on stream five (5) or more years after First Oil (FO), and the resources expected to come from Enhanced Oil Recovery (EOR). If these contingencies are removed, the total reserves in the Albertine Graben will increase to 1.4 billion barrels. To enable more Contingent resources to go into the classification of reserves, Government has put in place measures to ensure that Licensees plan for EOR early in the production of the different oil fields. EOR is the extraction of additional petroleum, beyond primary (or natural) recovery, by supplementing the natural forces in the reservoir through methods like polymer flooding, steam or hot water injection, injection of carbondioxide and thermal injection, among others. Accordingly, the companies with production licenses have presented estimates based on EOR mechanism using polymer flood. The reserves which are expected to become available only after implementation of EOR are therefore included under Contingent resources. Prospective resources are quantities of petroleum that are estimated to be discovered once exploration is undertaken. These include resource estimates from exploration licenses but also resource estimates from areas that are not yet licensed. In the Albertine Graben, over 60% of the acreage has not undergone exploration and 85% of the acreage is currently not under any licence. This means that 25% of the area which is currently not licensed has undergone some level of exploration. Attempts have been made to come up with resource estimates for the different prospects within these unlicensed areas. However, these are not reported because the prospects have not yet been drilled and therefore the resources have not been discovered.

PETROLEUM PRODUCTION

To-date nine (9) Production Licences (PLs) have been awarded over fourteen (14) fields in the Albertine Graben. Nine (9) of these fields are planned to be brought on stream at FO. These include Ngiri, Jobi-Rii, Gunya, Kasamene-Wahrindi, Kigogole-Nsoga and Kingfisher fields. The remaining five (5) fields with production licences i.e., Ngara, Ngege, Mputa, Nzizi and Waraga are planned to be brought on stream five (5) to eight (8) after FO subject to availability of ullage.

SUMMARY

Based on the above descriptions therefore, Uganda’s in place oil resources (Stock Tank Oil Initially in Place (STOIIP)) in the Albertine Graben are currently estimated at 6.5 billion barrels out of which 1.4 billion barrels are technically recoverable. Of the technically recoverable resources, 1.0 billion barrels are reserves (Recoverable at current conditions) and 0.4 billion barrels are Contingent resources. The planned lifecycle for production of the estimated reserves from the Kingfisher and Tilenga projects is twenty-five (25) years. This is expected to be prolonged when some of the current Contingent resources become reserves. It is important to note that the reported resources depend on the interpretation of the available data and the technology for extraction, which is existing at the time and therefore may change when more data becomes available.

For more information, contact ed@pau.go.ug